Synchrony Bank har sitt huvudkontor i Stamford, Connecticut, och är en onlinebank som betalar några av de högsta räntorna på insättningar som finns tillgängliga överallt.

Det är en del av Synchrony Financial-organisationen, som grundades 2003, men har sina rötter ända tillbaka till 1932.

Synchrony Financial har över 90 miljarder USD i tillgångar och är den största leverantören av privata kreditkort i USA

Men betyder det att de är rätt val för dig?

Synchrony utgör 42 % av marknaden för privatmärkta kreditkort, och samarbetar med sådana populära märken som:

Även om Synchrony Financial främst är involverat i kreditkort och finansiering, gör Synchrony Bank-divisionen snabbt ett namn för sig själv som en av de främsta onlinebankinstituten.

De betalar superhöga räntor på sina besparingar, penningmarknader och insättningsbevis (CD), som alla är helt försäkrade av FDIC.

Synchrony erbjuder också specialiserade IRA-CD-skivor och IRA-penningmarknader.

Som en nätbanksplattform kan du komma åt ditt konto varje dag och när som helst på dygnet.

Förutom mycket höga priser erbjuder Synchrony Bank även lojalitetsförmåner, baserat på storleken på ditt kontosaldo och/eller hur länge du har ett konto hos dem.

Om du letar efter hög avkastning på riskfria investeringar, är Synchrony Bank där du hittar dem.

Du kan öppna vanliga sparkonton, såväl som förtroendekonton och IRA.

För att kunna öppna ett konto hos Synchrony Bank måste du vara en amerikansk person för federala inkomstskatteändamål och ha en giltig hemvist i USA.

Följande information kommer att krävas för att öppna ett konto:

För att öppna kontot kan du ansöka online, kontakta en bankrepresentant som kan öppna kontot åt dig eller begära att en pappersansökan skickas till dig.

Pappersapplikationen kan också skrivas ut direkt från Synchrony Banks webbplats Resurscentersida, under Bankformulär.

Du kan ställa in din smartphone-åtkomst bara genom att logga in från din telefon med ditt kundinloggnings-ID och lösenord.

Med ett högavkastande sparkonto. du kan spara pengar samtidigt som du tjänar dem. För smarta och effektiva sparande är ett högavkastande sparkonto ett gångbart alternativ. Öppna ett konto idag genom att klicka på ditt tillstånd nedan. Open an Account Today

Med ett högavkastande sparkonto. du kan spara pengar samtidigt som du tjänar dem. För smarta och effektiva sparande är ett högavkastande sparkonto ett gångbart alternativ. Öppna ett konto idag genom att klicka på ditt tillstånd nedan. Open an Account Today Synchrony Bank Perks. When you open an account with Synchrony Bank, you are automatically enrolled in the perks program.

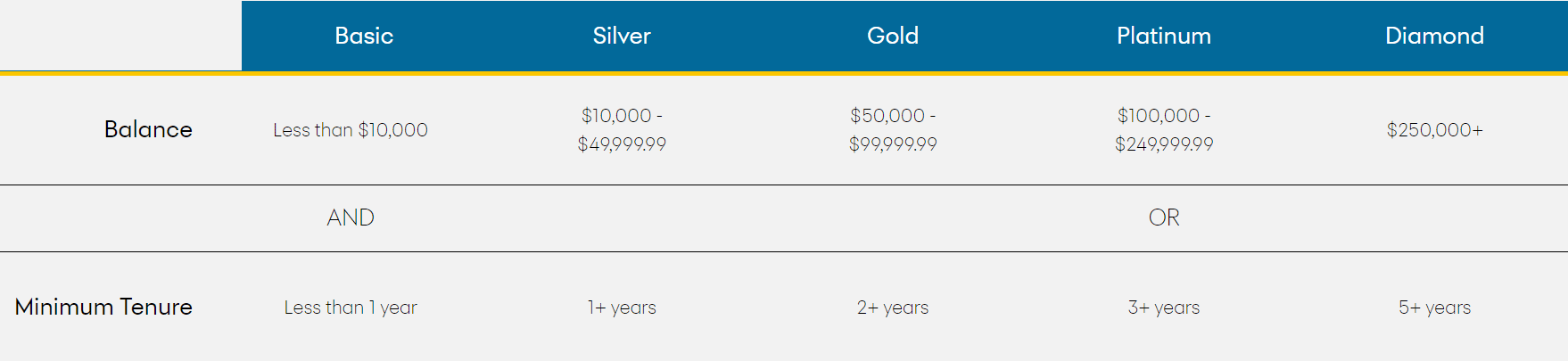

Rewards are offered based on the balances that you keep as well as the length of time that you’re a customer.

This entitles you to get benefits and discounts without having to keep track of your points.

The Perks program has five different levels:

They entitle you to travel and leisure benefits, ATM fee reimbursements and more.

At the Diamond level, you’ll be entitled to a dedicated customer service phone number, access to the bank’s webinar series, three wire transfers per statement cycle, and unlimited ATM reimbursements.

The Perk schedule looks like this:

Account security. Synchrony Bank offers multifactor authentication.

This provides you with an extra layer of security by creating an additional way to verify your identity.

When you register for your account or any time you change your password, you will be required to provide a one-time passcode. A four-digit code will be sent to your smartphone in a text message, or to your phone by voice.

That will prevent an unwanted third-party from gaining access to your account.

Synchrony Bank also offers 24-hour network security monitoring , as well as secure firewalls to protect your account from unauthorized Internet traffic.

Full online and smartphone account access. You can access all features of the banking experience from your mobile device, including your account summary and activity, external accounts, transfer of funds, pending transfers, and loyalty perks.

You can also deposit checks with your smartphone, as well as access secure messaging and send emails to the bank.

Accessing your funds. Synchrony Bank does not offer a checking account.

However, you can request checks in order to access your Money Market account . You can also request a wire transfer to another bank by calling a bank representative during call-center hours.

You will need to register the external bank account through the Synchrony Bank online banking platform in order to create quick and easy electronic transfers.

However, be aware transfers and withdrawals are limited to six per statement cycle for both the Money Market and High Yield Savings accounts. (This is a typical requirement for both types of accounts throughout the banking industry.)

Transferring money to your Synchrony Bank account. You can move money into your Synchrony Bank account through electronic debit (ACH).

You can also write yourself a check from an external bank, or get a cashier’s check, and then mail the deposit to Synchrony Bank.

Finally, you can always wire funds from an external bank into your Synchrony Bank account.

Synchrony Bank also accommodates direct deposits from third parties or the use of mobile check deposits. You can make a deposit just by taking a picture of the check that you are depositing, using your smartphone device.

ATM Card (optional). This gives you access to cash and other basic banking transactions from both the High Yield Savings and Money Market accounts. You can use them at any ATMs displaying the Plus or Accel logos.

There are no ATM fees if you use a terminal within these networks.

ATM cash withdrawals are limited to $1,010 per day, while point-of-sale purchases are limited to $510 per day. Point-of-sale transactions count toward the per account limitation of no more than six transfers or withdrawals per statement cycle.

In addition, the ATM card cannot be used as a credit card (debit card only).

Customer service. You can access customer service by phone, Monday through Friday, 8:00 AM to 10:00 PM, Eastern Time.

They are also available on Saturdays, from 8:00 AM to 5:00 PM. But you can also access your account 24 hours a day, seven days a week, on your computer, tablet or smartphone.

All accounts are FDIC insured. That’s up to $250,000 per depositor.

Link your account to Mint.com. Mint.com allows integration with Synchrony Bank deposit accounts.

Once your Synchrony Bank account is registered, the account can be registered for integration with Mint.com.

Synchrony Bank IRAs. Synchrony Bank offers IRA accounts through both their Money Market Accounts and their CDs.

You can make a regular IRA contribution, or do a rollover to your IRA from an employer-sponsored plan. You can have either a traditional IRA or a Roth IRA.

Synchrony Financial. Credit cards are available through Synchrony Financial. Synchrony partners with more than 365,000 retailers and vendors to arrange retail credit card programs.

They also offer the healthcare credit card, Care Credit .

It is accepted by more than 200,000 healthcare provider locations nationwide, offering a revolving line of credit that can be used for health-related expenses.

This includes expenses that are not normally covered by health insurance, including dentistry, chiropractic, cosmetic treatments, LASIK surgery, eyeglasses, hearing aids, weight loss programs and pet care.

High Yield Savings

Synchrony Bank is currently paying 1.20% average percentage yield (APY) on all high yield savings balance levels. Unlike many banks, however, you don’t have to have a high account minimum to get the advertised rate either.

It’s available for all balance levels.

Regular Money Market Funds and IRA Money Market Funds

Synchrony Bank is currently paying 0.85% APY on these accounts, which is many times higher than the 0.13% average being paid on money market accounts industrywide.

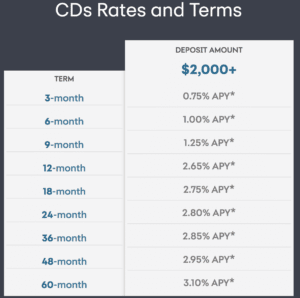

Regular Certificates of Deposit (CDs) and IRA CDs

You need a minimum of $2,000, and you can get CDs with maturities ranging from three months to 60 months. The current APYs look like this (as of December of 2018):

To put the yield on the 60-month CD into perspective, the five-year US Treasury Note pays only 2.70% as of the same date.

Synchrony Bank offers three basic services for businesses:Credit Services, Synchrony Connect and Care Credit for healthcare practices.

Synchrony Credit Services

Synchrony Financial is the largest provider of private label credit cards in the U.S. based on purchase volume and receivables. They tailor credit card programs to engage customers at point-of-sale, online, or through mobile devices.

They develop platforms that generate fast credit decisions, as well as easy online payments.

They also offer promotional financing for major consumer purchases, plus loyalty programs to generate repeat purchases and brand loyalty.

They offer the following credit services to businesses:

Synchrony Bank works to create customized financing programs for different business niches, including regional and national retailers, local merchants, manufacturers, buying groups, industry associations, and healthcare service providers.

They even offer a business center that offers tools to help businesses with sales, marketing, sales training, and consumer research trends.

Synchrony Connect

This is a value-added program offered by Synchrony Financial that helps business partners in areas that do not involve credit specifically. They can provide information related to innovation, marketing, sales and relationship management.

They also offer organizational strategies and talent management.

The goal of the program is to improve operations, including customer service, risk management, information technology, financial planning and process management.

Services are offered on a one-on-one basis, including consulting projects, multiclient webinars, and access to Synchrony Financial’s online portal.

Care Credit

Just as Synchrony Financial offers bank customers Care Credit for healthcare expenses, it also makes the credit service available to healthcare practices for their patients.

It enables healthcare practices to offer qualified patients a flexible way to finance or budget for procedures that they need, or even those that are not covered by health insurance.

Care Credit is one of the largest providers of promotional financing in the healthcare industry. They have handled over 20 million accounts since the program was founded.

It offers a revolving line of credit and financing options so that patients can more easily afford the healthcare services that they need.

Once again, it can be used for dentistry, cosmetic treatments, LASIK surgery, eyeglasses, hearing aids, and pet care, among other services, all of which are usually not covered by health insurance.

If your primary goal is to have a bank where you can get the very highest rates possible on completely safe investments, then Synchrony Bank is exactly what you’re looking for.

It’s also an outstanding platform for small business owners, who want to be able to offer financing options to their customers and clients.

But if you’re looking for a full-service banking platform, Synchrony Bank won’t fit the bill, nor is it meant to. It doesn’t offer many of the usual services that you will find in a full-service bank.

For example, it does not offer checking accounts, a network of local branches, or the types of lending programs (general-purpose credit cards, auto loans, and home mortgages) that are offered by typical full-service banks.

Synchrony Bank is best for someone who has a satisfactory banking arrangement and is looking either for higher returns on their savings, or the business credit services that are offered by Synchrony Financial.

Synchrony does both of those tasks extremely well, and it’s worth developing a relationship with them just for those services alone.

If you want more information, or you’re interested in opening up an account, check out the Synchrony Bank website. If you’re looking for the highest rates on savings available, you’ll have found the right bank.