Investerare med långvarig utdelningstillväxt känner till kraften i tålamod.

De bästa utdelningsaktierna – företag som höjer sina utbetalningar som ett urverk decennium efter decennium – kan ge överlägsen totalavkastning, även om de visar uppenbarligen ho-hum-avkastningar. Regelbundna utdelningshöjningar höjer också avkastningen på en investerares ursprungliga kostnadsbasis. Håll dig kvar tillräckligt länge, och den föga imponerande avkastningen på 1 % du fick på din initiala investering kan växa med stormsteg.

Och, som alltid, låt oss inte glömma magin med sammansättning. Som Ben Franklin berömt sa:"Pengar tjänar pengar. Och pengarna som pengar tjänar, tjänar pengar."

Företag med lång historia av årlig utdelningstillväxt erbjuder också en viss sinnesro. När ett företag lyckas höja sin utdelning år efter år, genom lågkonjunktur, krig, marknadskrascher och mer, gör det ett kraftfullt uttalande om både sin finansiella motståndskraft och sitt engagemang för aktieägarna.

Ange utdelningsaristokraterna.

Dividend Aristocrats är företag i S&P 500 Index som har höjt sina årliga utbetalningar varje år under minst 25 år i rad. Den här listan över S&P:s bästa utdelningsaktier är en blandning av kända namn och mer obskyra företag, men de spelar alla nyckelroller i den amerikanska ekonomin. Och även om de är utspridda över i stort sett alla sektorer på marknaden, har de alla en sak gemensamt:ett engagemang för pålitlig och långsiktig utdelningstillväxt.

En snabb notering:S&P Dow Jones Indices lade till tre nya namn för 2021, och ersatte Raytheon (RTX), Carrier Global (CARR) och Otis Worldwide (OTIS) efter att spin-offs och ett förvärv avvecklade det tidigare United Technologies-imperiet.

Här är de nuvarande 65 utdelningsaristokraterna, inklusive de senaste ansiktena att gå med i gruppen. Följande namn har varit bland de bästa utdelningsaktier för inkomsttillväxt under de senaste decennierna, och de är ett bra ställe att börja om du vill lägga till utdelningsstridsskepp till dina långsiktiga portföljer.

NextEra Energy (NEE) är ett nytt tillägg till Aristokraterna. Verktygsbolaget lades till elitgruppen av utdelningsodlare i januari 2021.

Företaget har två huvudsakliga verksamheter:Florida Power &Light (FPL) är Floridas största elföretag, medan NextEra Energy Resources är en stor aktör inom vind- och solenergi. Analytiker gillar den här kombinationen av ett framgångsrikt reglerat verktyg med en snabbare växande verksamhet för förnybar energi. Befolkningstillväxt och Biden-administrationens fokus på förnybar energiproduktion borde tjäna företaget väl.

Bolaget höjde senast sin utdelning i februari 2021 och höjde den kvartalsvisa utdelningen med 10 % till 38,5 cent per aktie.

International Business Machines (IBM), en komponent i Dow Jones Industrial Average, är inte riktigt så lysande som det en gång var. Företagets intäkter har sjunkit stadigt under större delen av ett decennium, skadad av dess status som också drevs inom kritiska tillväxtområden som socialt, mobilt, analytics och molninfrastrukturverksamheten.

Och ändå har Big Blue, genom alla sina snedsteg och snubblar, varit en utdelningstrogen, och fick medlemskap i Dividend Aristocrats i januari 2021.

I april 2021 höjde IBM kvartalsutdelningen med ett öre till 1,64 USD per aktie, vilket markerar det 26:e året i rad med ökningar. IBM har betalat ut kvartalsvisa utdelningar i följd sedan 1916. Viktigt är att företaget har resurserna för att hålla tillväxten vid liv, vilket är en egenskap du förväntar dig att se bland de bästa utdelningsaktierna.

Albemarle (ALB), som tillverkar specialkemikalier som litium, höjde senast sin utdelning i februari 2021 – en höjning med 1,3 % till 39 cent per aktie kvartalsvis.

Albemarles produkter fungerar helt bakom kulisserna, men dess kemikalier fungerar i ett antal industrier, från renbränsleteknik till läkemedel till brandsäkerhet. Men litium är kärnan i tjurfallet.

"Den positiva utsikterna för införandet av elfordon är ALB:s viktigaste drivkraft, och vi tror att det finns en större uppåtrisk för denna trend att accelerera under en blå våg i USA", säger CFRA Research.

Cerpillar (CAT), världens största tillverkare av tung anläggnings- och gruvutrustning, lades till Dividend Aristocrats i januari 2019.

CAT har betalat en vanlig utdelning utan att misslyckas sedan 1933 och har höjt sin utbetalning varje år i 27 år. Senast höjde företaget utdelningen i juni 2021, med 8 % till 1,11 USD varje kvartal.

De bästa utdelningsaktier har gott om fritt kassaflöde för att täcka utdelningen, och CAT markerar den rutan lätt. Under de 12 månader som slutade den 31 december 2020 hade CAT fritt kassaflöde efter skuldbetalningar på 1,97 miljarder USD efter att ha betalat ut 2,2 miljarder USD i utdelningar.

Essex Property Trust (ESS), som lades till Dividend Aristocrats 2020, är en fastighetsinvesteringsfond (REIT) som investerar i lägenheter främst på västkusten.

REIT blev börsnoterat 1994 och har höjt sin utbetalning sedan dess. Den senaste ökningen kom i februari 2021, då ESS höjde kvartalsutdelningen med 5 cent till 2,09 $ per aktie.

Tack vare sin stadiga och generösa ström av utdelningshöjningar har Essex en årlig uppdelad 10-årig tillväxttakt på 101,2 %. Under 20 år kommer företagets årliga utdelningstillväxt till nästan 250 %.

Expeditions International of Washington (EXPD) lades till Aristokraterna i januari 2020. Logistikföretaget höjde senast sin halvårsutdelning i maj 2021, till 58 cent per aktie från 52 cent per aktie.

Det har varit några tuffa år för transportföretaget. Handelsspänningar mellan USA och Kina under den tidigare presidentadministrationen skadade EXPD mycket. Och nu har covid-19 stört tonnagevolymer för flygfrakt och sjöcontainertransporter.

Genom det hela har EXPD dock förblivit engagerad i sin halvårsutdelning, som den har höjt varje år i mer än ett kvartssekel. En konsekvent låg utbetalningskvot bör hjälpa till att säkerställa att Expeditors har gott om resurser för att hålla streaken vid liv och behålla sin plats på listan över de bästa utdelningsaktierna.

Fastighetsinkomst (O) är en REIT som investerare kan lita på för en stadig inkomst, men det finns en annan aspekt av denna aktie som kan passa vissa inkomstinvesterare:Realty Income är en sällsynt sort av månatliga utdelningsaktier.

Företaget äger mer än 6 700 kommersiella fastigheter som hyrs ut till mer än 630 hyresgäster – inklusive Walgreens (WBA), 7-Eleven, FedEx (FDX) och Dollar General (DG) – verksamma i 58 branscher.

Realty Income genererar vanligtvis förutsägbara kassaflöden tack vare den långsiktiga karaktären hos dess hyresavtal. Företaget har levererat en sammansatt genomsnittlig årlig utdelningstillväxt på 4,3 % sedan 1994.

REIT:s senaste höjning, som deklarerades i november 2021, höjde den månatliga utdelningen till 24,6 cent per aktie från 23,6 cent per aktie.

Chubb (CB) lades till Dividend Aristocrats i januari 2019. Försäkringsbolaget höjde senast sin utbetalning i maj 2021, till 80 cent per aktie från 78 cent. Med det steget nådde Chubb sitt 28:e år i rad med utdelningstillväxt.

Som världens största börsnoterade egendoms- och skadeförsäkringsbolag har Chubb verksamhet i 54 länder och territorier. Det är inte det mest spännande ämnet för middagssamtal, men det är en lönsam verksamhet som stödjer en långvarig utdelning.

Och Chubbs stadiga utdelningsökningar ökar verkligen över tiden. Faktum är att försäkringsbolaget har en 20-årig årlig utdelningstillväxt på mer än 134 %.

People's United Financial (PBCT) är ett sällsynt bankspel i denna samling av utdelningsaktier. Det regionala finansiella tjänsteföretaget – som driver mer än 400 filialer i Connecticut, New York, Massachusetts, Vermont, New Hampshire och Maine – har mer än 63 miljarder dollar i totala tillgångar. Den ärevördiga institutionen i New England spårar sina rötter tillbaka till 1842.

I februari 2021 slöt M&T Bank (MTB) en överenskommelse om att förvärva People's United Financial i en aktietransaktion till ett värde av 7,6 miljarder USD. Det återstår att se om M&T tar PBCT:s plats på listan över Dividend Aristokrater.

PBCT höjde senast sin utdelning i april 2021, till 18,25 cent per aktie per kvartal från 17,75 cent per aktie.

West Pharmaceutical Services (WST) lades till Dividend Aristocrats i januari 2021 som ett erkännande av dess nästan tre decennium av årliga ökningar.

WST är verksamt i en kritisk sektor av sjukvårdens leveranskedja, och tillverkar förpackningskomponenter och leveranssystem för injicerbara läkemedel och andra medicinska produkter. Bulls noterar att efterfrågan på COVID-19-vacciner ökar efterfrågan på företagets produkter. Samtidigt bör biofarmaceutiska industrins robusta pipeline stödja långsiktig tillväxt.

Bolaget höjde senast utdelningen i oktober 2021 – en ökning med 5,9 % av den kvartalsvisa utdelningen till 18 cent per aktie. Rikligt fritt kassaflöde och en låg utdelningskvot bör försäkra aktieägarna om att de årliga utdelningsökningarna kommer att fortsätta.

Linde (LIN) blev en Dividend Aristocrat i slutet av 2018 efter att den slutförde sin sammanslagning med Praxair, som i sig lades till på den lysande listan över S&P 500:s bästa utdelningsaktier för inkomsttillväxt i januari 2018. Linde och Praxairs bindning på 90 miljarder dollar skapat världens största industrigasföretag.

Praxair höjde sin utdelning under 25 år i rad innan fusionen, och det sammanslagna bolaget fortsätter att vara en stadig utdelningsbetalare. Före sammanslagningen höjde Linde, nu med huvudkontor i Dublin, sin utdelning varje år sedan 2014. Lindes senaste höjning kom i januari 2021 – en ökning med 10 % i den kvartalsvisa utbetalningen till 1,06 USD per aktie.

Med gott om fritt kassaflöde efter betalningar av skulder, borde Linde ha gott om eldkraft för att hålla utdelningen vid liv.

A.O. Smith (AOS), en tillverkare av vattenvärmare för kommersiella och bostäder, är ett relativt nyligen tillskott till Dividend Aristocrats, som går in i klubben 2018. I oktober 2021 tillkännagav de en höjning med 7,7 % av sin kvartalsvisa utbetalning till 28 cent per aktie. Det markerade det 29:e året i rad med utdelningshöjningar för industriföretaget.

Som ett resultat är den femåriga sammansatta årliga tillväxttakten för AOS utdelning nu på mer än 17 %. Den femåriga årliga utdelningstillväxten når samtidigt 158 %.

Med gott om fritt kassaflöde och en utbetalningskvot under genomsnittet, kan investerare räkna med att AOS fortsätter att öka utdelningen.

Ecolab (ECL) tillhandahåller vattenrening och andra underhållstjänster i industriell skala för flera industrier, inklusive livsmedel, hälsovård och olja och gas. Praktiskt sett hjälper dess produkter till att optimera allt från offshore oljeproduktion till elektronikpolering till kommersiella tvätterier.

Ecolabs förmögenheter kan dock avta när industriella behov fluktuerar; till exempel, när energibolag minskar utgifterna, kommer ECL att känna brännan.

På lång sikt har dock denna Dividend Aristokrats aktier varit en bevisad vinnare. Aktien har levererat marknadsslående totalavkastning under de senaste fem-, 10- och 15-årsperioderna. Det är inte en liten del tack vare 30 år av utdelningsökningar i följd. ECL:s senaste höjning kom i december 2021, med en ökning med 6 % av kvartalsbetalningen till 51 cent per aktie.

Roper Technologies (ROP) – ett industriföretag vars verksamheter inkluderar bland annat medicinsk och vetenskaplig bildbehandling, RF-teknik och mjukvara samt energisystem och kontroller – har tjänat intäkter i nästan tre decennier.

Den senaste höjningen deklarerades i november 2021, då den kvartalsvisa utbetalningen höjdes 10,2 %, till 62 cent per aktie.

En kombination av förvärv, organisk tillväxt och starkare marginaler har hjälpt Roper att få utdelning utan att tänja på vinsten. Och även om avkastningen kanske inte ser så mycket ut, har tålmodiga investerare kommit att inse vad ROP:s stadiga utdelningsökningar har gjort för deras avkastning.

Försvarsentreprenör General Dynamics (GD) är en av de nyare medlemmarna i Dividend Aristocrats, efter att ha lagts till på elitlistan över bästa utdelningsaktier för tillväxt under 2017.

Generösa militära utgifter har hjälpt till att driva på denna utdelningsakties stadiga ström av kontanter som returneras till aktieägarna. I en av de senaste stora affärerna tilldelades företaget i december 2020 ett kontrakt på 4,6 miljarder US-dollar för den senaste konfigurationen av Abrams Main Battle Tank.

General Dynamics har ökat sin distribution i tre decennier nu. Den senaste ökningen tillkännagavs i mars 2021, då GD höjde den kvartalsvisa utbetalningen med 8,2 % till 1,19 USD per aktie. Med sin utbetalningskvot under genomsnittet på 41 % borde General Dynamics ha tillräckligt med utrymme för mer utdelningstillväxt.

Chevron (CVX) är en integrerad oljejätte som även har verksamhet inom naturgas och geotermisk energi. Det råkar också vara det enda namnet på energisektorn bland de 30 aktierna i Dow Jones Industrial Average.

Analysts praise Chevron for having the strongest financial base in its peer group, a highly attractive portfolio of assets, and the "most straightforwardly positive risk/reward profile" of any stock in its sub-sector.

Perhaps most important for income investors, CVX has more than three decades of uninterrupted dividend growth under its belt, and management has said it will protect the payout at all costs. Chevron's last increase came in April 2021 with a 4% bump in the quarterly dividend to $1.34 per share.

Atmos Energy (ATO), which distributes and stores natural gas, was added to the Dividend Aristocrats in January 2020. The Dallas-headquartered firm serves more than 3 million distribution customers in more than 1,400 communities across eight states, with a large presence in Texas and Louisiana.

Analysts, who are mostly bullish on the name, point to ATO's strong fundamentals and increasing U.S. demand for natural gas. A robust balance sheet and potential for above-average earnings growth also recommend the stock.

Atmos clinched its 35th straight year of dividend growth in November 2021, when it announced an 8.8% increase to 68 cents a share per quarter.

A steady stream of acquisitions helped wholesale drug and medical device distributor Cardinal Health (CAH) become the giant that it is today. Its most recent acquisition – a $2.2 billion all-stock deal for Bindley Western Industries – closed in February 2021.

Like the rest of the medical device industry, CAH faced challenges during the pandemic as patients put off elective surgeries. But the company still managed to generate ample free cash flow and the dividend increases such cash flow supports.

Indeed, Cardinal Health has upped the ante on its annual payout for 35 years and counting. The Aristocrat last raised its disbursement in August 2021, declaring a 1% increase in the quarterly dividend to 49.08 cents per share.

Asset managers such as T. Rowe Price (TROW) have been losing market share to indexed funds of the type Vanguard offers, but the company still boasts a massive (and growing) $1.67 trillion in assets under management (AUM).

Strong performance from actively managed funds and the firm's focus on the growing retirement market are just two factors boosting AUM, analysts note.

T. Rowe Price has improved its dividend every year for 35 years, including an ample 20% increase to the payout announced in February 2021. Given its track record as one of the best dividend stocks, investors can expect a 36th consecutive dividend hike in 2022.

Telecommunications stocks are synonymous with dividends. Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks.

AT&T (T) – the largest U.S. telecom company – is a perfect example.

AT&T has raised its dividend on an annual basis for 36 consecutive years, and typically boasts one of the highest yields in the S&P 500. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon (VZ).

*AT&T didn't raise its dividend in 2020 and appears unlikely to raise it in 2021. Indeed, analysts expect AT&T to cut its dividend in 2022 because of the DirecTV and WarnerMedia spinoffs. Going two years without raising means AT&T will likely be bumped from the list in 2022.

McCormick (MKC) – the maker of herbs, spices and other flavorings – has been bulking up with acquisitions over the years to drive sales growth, and the deals have been paying off.

The strategy should to provide support for McCormick's dividend, which has been paid for 97 consecutive years and raised annually for 36. Most recently, in November 2021, the company hiked its quarterly dividend by 8.8% to 37 cents per share. McCormick's current annualized dividend of $1.36 per share represents an increase of 10% over the annual dividend of $1.24 per share paid in fiscal 2020.

With ample free cash flow and a reasonable payout ratio, MKC has been able to generate an annualized 10-year dividend growth rate of more than 107%. The company's 20-year annualized dividend growth rate tops 471%

Brown-Forman (BF.B) is one of the largest producers and distributors of alcohol in the world. Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known brands, with the former helping drive long-term growth.

Unlike many of the best dividend stocks on this list, you won't have a say in corporate matters with the publicly traded BF.B shares. They hold no voting power. And most of the voting-class A shares are held by the Brown family.

Still, you can enjoy in the company's gains and dividends. That payout has been on the rise for 38 consecutive years and has been delivered without interruption for 76. Most recently, Brown-Forman last upped the quarterly ante in November 2021, by 5% to 18.85 cents per share.

Cintas (CTAS) is perhaps best-known for providing corporate uniforms, but the company also offers maintenance supplies, tile and carpet cleaning services and even compliance training.

As such, it's seen by some investors as a bet on jobs growth, and tends to move ahead of any pick-up in hiring during and economic recovery. Indeed, CTAS has worked pretty well as a proxy for employment in the past.

Regardless of how the labor market is doing, Cintas is a stalwart when it comes to being one of the best dividend stocks. The company has raised its payout every year since going public in 1983. However, those have been annual distributions up until this year, when the company switched to quarterly payouts.

Most recently, in July 2021, CTAS raised its quarterly dividend by 26.7% to 95 cents per share.

Amcor (AMCR) is a pretty boring company. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care.

But sometimes boring can be beautiful, and that's the case with Amcor when it comes to reliable income. It was named to the list of payout-hiking dividend stocks at the start of 2020 after its June acquisition of Bemis. Bemis, which fell out of the S&P 500 Index and thus the Aristocrats in 2014, rejoined by merit of its merger with Amcor.

The company last raised its dividend in November 2021, by 2.1% to 12 cents a share. The analyst community expects the company to deliver average annual earnings per share growth of 5.3% over the next three to five years.

Air Products &Chemicals (APD) has spent much of the past few years restructuring. Under pressure from investors, it started to shed some weight, including spinning off its Electronic Materials division and selling its Performance Materials business.

Air Products, which dates back to 1940, now is a slimmer company that has returned to focusing on its legacy industrial gases business. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 39 years in a row. That includes a 12% upgrade in January 2021 to $1.50 a share.

"In fiscal 2020, we were proud to return about $1.1 billion to our shareholders through our dividend while having significant distributable cash flow for high-return industrial gas investments," CEO Seifi Ghasemi said in a press release at the time.

Aflac (AFL) is a supplemental insurance company – popularized by the loud Aflac duck – with roots going back to 1955 that covers numerous workplace offerings, such as accident, short-term disability and life insurance.

Although the COVID-19 pandemic slammed the insurance industry, AFL stock returned to pre-crash levels by early 2021, helped by the market's confidence in its dividend. And with a conservative payout ratio and almost four straight decades of dividend growth, that confidence is indeed well placed.

Aflac last raised its payout in November 2021, upping the quarterly distribution by 21.2% to 40 cents per share.

Exxon Mobil (XOM) remains one of the world's largest energy companies and is the biggest oil company by market value in the U.S. It was removed from the blue-chip Dow Jones Industrial Average in August 2020, and will likely be dropped from the Dividend Aristocrats in January.

This dividend stalwart and its various predecessors have strung together uninterrupted payouts since 1882. To its credit, XOM was one of the few energy companies that didn't cut or suspend its payout amid the pandemic-caused crash in oil prices.

However, it did put a pause on its dividend growth.

The Dow component's quarterly distribution remained unchanged in 2020 amid the COVID-19 crisis. However, membership in the Dividend Aristocrats is based on consecutive increases to the annual payout; a 1.1% bump to the dividend in October 2021 ensured that XOM will have a slightly higher annual payout than in 2020, and thus remain in the club.

The name Franklin Resources (BEN) might not be well-known among investors; however, along with its subsidiaries, it's called the more familiar Franklin Templeton investments. The global investment firm is one of the world's largest with $1.53 trillion in assets under management, and is known for its bond funds, among other offerings.

Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds.

Meanwhile, the asset manager remains attractive as an income provider for investors looking for the best dividend stocks. It has raised its dividend annually since 1981, including a 3.6% hike to 29 cents per share quarterly announced in December 2021.

Thanks to its 2017 acquisition of Valspar, Sherwin-Williams (SHW) is one of the largest paints, coatings and home-improvement companies in the world.

Income investors certainly don't need to worry about Sherwin-Williams' steady and rising dividend stream. SHW has hiked its distribution every year since 1979. The most recent hike came in February 2021 with a 23.1% raise to the quarterly payment to $1.65 per share. Additionally, the board added 15 million shares to the firm's stock repurchase authorization.

SHW's dividend now boasts a 10-year annualized growth rate of 272%.

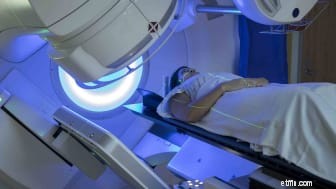

Medtronic (MDT), one of the world's largest makers of medical devices, is an income machine. Most recently, in May 2021, MDT lifted its quarterly payout by 8.6% to 63 cents a share. Its dividend per share has grown by 47% over the past half-decade and has grown at a 16% compounded annual growth rate over the past 44 years, Medtronic says.

MDT is able to steer generous sums of cash back to shareholders thanks to the ubiquity of its products. It holds more than 47,000 patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons.

Look around a hospital or doctor's office – in the U.S. or in more than 160 other countries – and there's a good chance you'll see its products.

Clorox (CLX), whose brands include its namesake bleaches, Glad trash bags and Hidden Valley salad dressing, was a big early beneficiary of the pandemic as demand surged for its ubiquitous cleaning materials.

That surge in demand has since passed, but the dependable and defensive nature of Clorox's business has allowed the company to increase its payout every year since 1977. The most recent raise came in June 2021 with a 5% bump to $1.16 per share per quarter.

CLX boasts a reasonale payout ratio and ample free cash flow, which should ensure a 45th consecutive increase to the dividend in 2022.

The world's largest hamburger chain also happens to be a dividend stalwart. Changing consumer tastes will always be a risk, but McDonald's (MCD) dividend dates back to 1976 and has gone up every year since. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core.

MCD last raised its dividend in September 2021, when it lifted the quarterly payout by 7% to $1.38 a share. That marked its 45h consecutive annual increase. The company's 10-year annualized dividend growth rate stands at 123%. And over the past 20 years? The annualized growth rate tops 2,244%.

U.K.-based water-treatment company Pentair (PNR) whose divisions include Flow Technologies, Filtration &Process and Aquatic &Environmental Systems, is always looking to expand its capabilities.

In early January 2021 it closed on its acquisition of Rocean, a maker of countertop filtration systems for the home. Terms were undisclosed. That followed its 2019 acquisition of Aquion for $160 million in cash.

Pentair has raised its dividend annually for 46 straight years, most recently in December 2021 by 5% to 21 cents a quarter. A modest payout ratio and consistently ample free cash flow helps ensure that Pentair will continue to be one of the best dividend stocks.

Tracing its roots back to a single drugstore founded in 1901, Walgreens Boots Alliance (WBA) has boosted its dividend every year for more than four decades. Mostly recently, in July 2021, it raised the quarterly dividend by 2.1% to 47.75 cents per share. WBA's five-year annualized dividend growth rate now stands at 32.6% as a result.

As for its origins, Walgreen Co. merged with Alliance Boots – a Switzerland-based health and beauty multinational – in 2014 to form the current company. Walgreens Boots Alliance and its predecessor company have paid a dividend in 355 straight quarters, or more than 88 years.

Automatic Data Processing (ADP) is the world's largest payroll processing firm, responsible for paying nearly 40 million employees and serving more than 920,000 clients across 140 countries.

Through good economic times and bad, one of ADP's great advantages is its "stickiness." After all, it's complicated and expensive for corporate customers to change payroll service providers. That competitive advantage helps throw off consistent income and cash flow. In turn, ADP has become a dependable dividend payer – one that has provided an annual raise for shareholders since 1975.

ADP's most recent dividend increase came in November 2021 when it lifted the quarterly payout 11.8% to $1.04 per share. The company's five-year annualized dividend growth rate stands at 83%.

The world's largest company by revenue might not pay the biggest dividend, but it sure is consistent. Walmart (WMT) has been delivering meager penny-per-share increases to its quarterly dividend since 2014, including February 2021's bump to 55 cents per share.

But that's been enough to maintain its 47-year streak of consecutive dividend increases. WMT's annualized payout now stands at $2.20 per share, up 1.8% from the $2.16 per share it returned the prior year.

And shareholders can count on the increases to keep coming. The discount retailer, which operates approximately 11,400 stores and e-commerce websites under 54 banners in 26 countries, is a cash machine. WMT has generated average annual free cash flow of more than $15 billion over the past seven years.

Archer Daniels Midland (ADM) processes ingredients for food and feed, including corn sweeteners, starches and emulsifiers such as lecithin. It also has a commodity trading business. It's a truly global agricultural powerhouse, too, boasting customers in 200 countries served by more than 800 facilities.

Archer Daniels Midland has paid out dividends on an uninterrupted basis for 89 years. The most recent hike came in January 2021, when ADM increased the quarterly payout by 2.8% to 37 cents a share. The move extended the dividend stock's streak of annual raises to 47 years.

Consolidated Edison (ED) is the largest utility company in New York State by number of customers. Founded in 1823, it provides electric, gas or steam services to roughly 3.5 million customers in New York City and Westchester County. ConEd also happens to be North America's second-largest solar power provider, and is investing in electric vehicle charging programs and other green energy endeavors.

Like most utilities, Consolidated Edison is highly regulated but enjoys a fairly stable stream of revenues thanks to limited direct competition – but not a lot of growth. The longtime Dividend Aristocrat has hiked its annual distribution without interruption for close to five decades. In January 2021, the utility raised its quarterly payout 1.3% to 77.5 cents per share from 76.5 cents per share.

Formerly known as McGraw Hill Financial, S&P Global (SPGI) is the company behind S&P Global Ratings, S&P Global Market Intelligence and S&P Global Platts. Although most investors probably know it for its majority stake in S&P Dow Jones Indices – which maintains the benchmark S&P 500 index and the blue-chip Dow Jones Industrial Average – it's also a central player in corporate and financial analytics, information and research.

S&P Global has paid a dividend each year since 1937 and is one of fewer than 25 companies in the S&P 500 that has increased its dividend annually for at least 48 years, the company notes. Most recently, in January 2021, SPGI raised its quarterly payout by a healthy 15% to 77 cents a share.

Leggett &Platt (LEG) has its hands in several pies, including producing steel wire; designing and manufacturing seating support systems for automobiles; and making components for manufacturers of upholstered furniture, beds and other home furnishings.

Although it's not a particularly famous company, it has been a dividend champion for long-term investors. Or had been, anyway. After 48 straight years of annual dividend increases, LEG did not lift the payout in 2020.

However, Leggett &Platt will maintain its membership in the Aristocrats thanks to a 5% upgrade to its dividend, to 42 cents per share, in May 2021, continuing its streak of increased payouts on an annual basis.

Nucor (NUE) is the largest U.S. steelmaker, but it's perhaps even more well known for its almost unrivaled commitment to dividend growth. As one of the best dividend stocks, Nucor has increased its dividend for 49 straight years, or every year since it began paying dividends in 1973.

The most recent increase came in December 2021 when NUE lifted the quarterly disbursement more than 23% to 50 cents per share. Nucor returned nearly $3.53 billion to shareholders in the form of share repurchases and dividend payments during the first 11 months of 2021.

Kimberly-Clark's (KMB) well-known brands include Huggies diapers, Scott paper towels and Kleenex tissues. Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns.

Kimberly-Clark has paid out a dividend for 84 consecutive years and has raised the annual payout for 49 consecutive years. In January 2021, the board of directors approved a 6.5% increase in the quarterly dividend to $1.14 a share. KMB also authorized a new $5 billion share repurchase program that supplements the current $5 billion authorization, which is expected to be completed later this year.

VF Corp. (VFC) is an apparel company with a large number of brands under its umbrella, including The North Face outdoor products, Timberland boots and Eastpak backpacks.

Importantly, as acquisitive as VFC has traditionally been, it's never been shy about tailoring its portfolio to maintain maximum profitability. In 2019, the company spun off its jeans business to shareholders via the publicly traded Kontoor Brands (KTB). The following year VFC acquired streetwear brand Supreme, but also divested its occupational workwear brands and business.

That sort of flexibility helps the company maintain the free cash flow required to keep the dividend increases coming. And, indeed, they do keep coming.

VFC in October 2021 raised its dividend for a 49th consecutive year – a 2% increase to 49 cents per share per quarter. The company also reinstated its share repurchase program, with an authorization to buy back up to $2.8 billion of its common stock. VFC suspended share repurchases in April 2020 due to the COVID-19 pandemic.

Not too long ago, investors fretted over a long-term slide in sales of carbonated beverages, but that turned out not to be a secular trend after all. Indeed, Grand View Research forecasts the global market for fizzy drinks to produce a compound annual growth rate of 4.7% through 2028.

Besides, PepsiCo (PEP) has an ace up its sleeve with its snacks business. The company's Frito-Lay division is known for Doritos, Tostitos, Rold Gold pretzels, and numerous other brands. Meanwhile, demand for salty snacks remains solid.

Poängen? PEP's business remains fundamentally strong, and that should keep its dividend-growth streak intact. PepsiCo declared its 49th straight annual increase in May 2021 with a 5% bump in the quarterly dividend to $1.075 per share.

Abbott Laboratories (ABT) manufactures a wide variety of healthcare goods. Its portfolio includes branded generic drugs, medical devices, nutrition and diagnostic products. Some of its best-known products include Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices.

Abbott Labs dates all the way back to 1888. It first paid a dividend in 1924 and its dividend growth streak is long-lived too, at 50 years and counting. The last payout hike came in December 2021 — a 4.4% increase to 47 cents per share quarterly.

Medical devices maker Becton Dickinson (BDX) has bulked up quite a bit over the past few years. In 2015, it acquired CareFusion, a complementary player in the same industry. Then in 2017, it struck a $24 billion deal for fellow Dividend Aristocrat C.R. Bard, another medical products company with a strong position in treatments for infectious diseases.

As a result of all that M&A, BDX boasts a highly diversified portfolio of products – and the ample free cash flow needed to support continued dividend growth. BDX last raised its payout in November 2021 with a 4.8% raise to the quarterly dividend to 87 cents a share.

PPG Industries (PPG) makes coatings and paints for numerous industries, including aerospace, architecture, automotive and packaging. Its sprawling operations employ roughly 47,000 people in more than 50 countries.

PPG has paid a dividend since 1899 and has raised it annually for 50 years. A below-average payout ratio and solid outlook for long-term earnings growth should keep the dividend increases coming. PPG's last raise came in July 2021 with a 9.3% bump in the quarterly distribution to 59 cents per share.

Target (TGT) might be the No. 2 discount retail chain after Walmart in terms of revenue, but it doesn't take a back seat to the behemoth from Bentonville when it comes to dividends.

Target paid its first dividend in 1967, seven years ahead of Walmart, and has raised its payout annually since 1972. The last hike came in June 2021, when the retailer raised its quarterly disbursement by a whopping 32.4% to 90 cents a share.

With its well-below-average payout ratio, income investors can count on Target to keep hitting the mark for dividend growth. Indeed, over the past 10 years, its annualized dividend growth rate comes to more than 138%.

W.W. Grainger (GWW) – which not only sells industrial equipment and tools, but provides other services such as helping companies manage inventory – is expected to generate steady if not spectacular sales growth for the next few years. EPS growth, however, is forecast to increase at a double-digit percent rate.

Happily for the income-minded, Grainger has achieved annual dividend growth for a half century and maintains a below-average payout ratio. It renewed its Dividend Aristocrats membership card in April 2021 when it announced a 5.9% increase in the quarterly payout to $1.62 per share.

AbbVie (ABBV) is one of the highest yielders on this list of the best payout-improving dividend stocks. The pharmaceutical company was spun off from fellow Dividend Aristocrat Abbott Laboratories in 2013.

Including its time as part of Abbott, AbbVie has upped its annual distribution for 50 consecutive years. The most recent hike – an 8.5% increase to the quarterly payment to $1.41 per share – was declared in October 2021.

The company's best-selling treatments include Humira:a rheumatoid arthritis drug that has been approved for numerous other ailments, and that appears is on pace to surpass Lipitor as the best-selling drug of all time. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel.

Founded in 1912, Illinois Tool Works (ITW) makes construction products, car parts, restaurant equipment and more. While ITW sells many products under its namesake brand, it also operates businesses including Foster Refrigerators, ACME Packaging Systems and the Wolf Range Company.

In August 2021, Illinois Tool Works raised its quarterly dividend by 7% to $1.22 cents a share, bringing its streak of annual increases to 50 years. However, the company notes that excluding a period of government controls in 1971, that streak would stretch to 58 years. Either way, ITW's dividend sports a 10-year annualized growth rate of 240%.

Years of acquisitions have made Sysco (SYY) the food services and supply giant it is today. And the company's scale really came in handy during the pandemic, when it had to weather the closure of restaurants, bars and other food-service venues.

Happily for shareholders, the sudden and sharp downturn couldn't stop SYY from hiking its dividend for a 52nd consecutive year. The company last raised its payout in May 2021 with a 4.4% bump to 47 cents per share per quarter.

Power- and hand-toolmaker Stanley Black &Decker (SWK) has improved its cash distribution annually for more than half a century, including a 13% increase to 79 cents per share quarterly in July 2021.

SWK has bulked up through a series of deals over the past five years or so, including the acquisitions of Newell Tools, the Craftsman tool brand, IES Attachments, Nelson Fastener Systems and Consolidated Aerospace Manufacturing.

A low payout ratio and ample free cash flow should keep it SWK's dividend growth streak going.

Real estate investment trusts such as Federal Realty Investment Trust (FRT) are required to pay out at least 90% of their taxable earnings as dividends in exchange for certain tax benefits. Thus, REITs are well known as some of the best dividend stocks you can buy.

And few have been steadier than FRT, which owns retail and mixed-use real estate in several major metropolitan areas. Federal Realty Investment Trust has now hiked its payout every year for 54 years – the longest consecutive record in the REIT industry. It's latest increase – upping the quarterly dividend by a penny to $1.07 per share – was announced in August 2021.

Hormel Foods (HRL) is best known for Spam, but it's also responsible for its namesake meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces, among other brands.

But it shouldn't go unnoticed that the packaged food company is about as reliable as they come when it comes to income investing, having raised its payout every year for more than five decades.

Indeed, in November 2021, Hormel announced its 56th consecutive dividend increase – a 6% raise to 26 cents per share quarterly. The packaged foods company is rightly proud to note that it has paid a regular dividend without interruption since becoming a public company in 1928.

When it comes to home improvement chains, Home Depot (HD), a member of the Dow Jones Industrial Average, gets all the glory. But rival Lowe's (LOW) is the superior dividend grower.

Lowe's has paid a cash distribution every quarter since going public in 1961, and that dividend has increased annually for more than half a century. Most recently, in May 2021, Lowe's lifted its quarterly payout by 33% to 80 cents per share. Home Depot is a longtime dividend payer, too, but its string of annual dividend increases dates back only to 2010.

Lowe's 10-year annualized dividend growth rate now stands at 463%.

Colgate-Palmolive (CL) sells a wide range of consumer staples brands including its namesake toothpaste and dish soap, as well as Speed Stick deodorant, Murphy cleaning products and Tom's of Maine personal-care products.

Demand for Colagte's products tends to remain stable in both good economic times and bad, and that drives the free cash flow need to maintain its dividend growth streak.

And what a streak it is. Colgate's dividend dates back more than a century, to 1895, and the company has increased it annually for 59 years. CL last raised its payment in March 2021, upping the quartley distribution by a penny to 45 cents per share.

Johnson &Johnson (JNJ), founded in 1886 and public since 1944, operates in several different segments of the healthcare industry. In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine. It also manufactures medical devices used in surgery.

JNJ's diversification across three major business segments adds fortitude to this defensive dividend stock, and that helps income investors sleep better at night. The healthcare giant has increased its payout for nearly three decades and counting. The most recent hike came in April 2021 when JNJ increased the quarterly dividend by 5% to $1.06 per share.

Coca-Cola (KO) has long been known for quenching consumers' thirst, but it's equally effective at quenching investors' thirst for income. The company's dividend history stretches back to 1920, and the payout has swelled for 59 consecutive years. The last hike, announced in February 2021, was admittedly modest, though, at 2.4% to 42 cents per share per quarter.

Coca-Cola has worked hard to expand its offerings beyond traditional carbonated beverages, adding bottled water, fruit juices, sports drinks and teas to its product lineup. In addition to the namesake Coca-Cola brand, KO also sports names such as Minute Maid, Powerade, Simply Orange and Vitaminwater.

Property and casualty insurer Cincinnati Financial's (CINF) offerings include life insurance, annuities, umbrella insurance and a wide range of business insurance products.

Shares took a beating during the worst of the pandemic – and have since come bounding back – but even when CINF was bottoming out investors knew they could count on their dividends. Indeed, at 61 consecutive years and counting, Cincinnati Financial boasts one of the longest dividend growth streaks of any Dividend Aristocrat.

The P&C insurer most recently lifted its quarterly payout in January 2021, by 5% to 63 cents per share.

Shares in 3M (MMM), which makes everything from adhesives to electric circuits to N95 respirators, have been a long-time market laggard. But as much as this Dow stock has been a disappointment in terms of price appreciation, there's no questioning its value as a compounding source of income.

Indeed, the conglomerate's dividend dates back more than a century. Even better, 3M has been delivering annual dividend increases to investors for 63 years. The most recent hike came in early February 2021 with a 1% bump in the quarterly payout to $1.48 per share.

With major brands such as Tide detergent, Pampers diapers and Gillette razors, Procter &Gamble (PG) is among the world's largest consumer products companies.

Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. That hardly makes P&G completely recession-proof, but it does make the grade as one of the best dividend stocks because it's an equity income machine.

The Dow Jones Industrial Average component has paid shareholders a dividend since 1890, and has raised its payout annually for 65 years in a row. P&G's most recent raise came in April 2021 with a 10% bump to 86.98 cents per share quarterly.

Automotive and industrial replacement parts maker Genuine Parts (GPC) is best-known for the Napa brand. However, it also has deep roots in Mexico, where it operates under the AutoTodo brand, as well as Canada, where it operates as UAP.

Founded in 1928, Genuine Parts has long made returning cash to shareholders a priority.

The company has paid a cash dividend every year since going public in 1948 – or 65 consecutive years. The last hike – a 3% improvement to 81.5 cents per share quarterly – came in February 2021.

Emerson Electric (EMR) makes a wide variety of industrial products, ranging from control valves to electrical fittings.

The company has paid dividends since 1956 and has boosted its annual payout for 66 consecutive years, including its last increase – 2% to 51.5 cents per share quarterly – declared in November 2021. As a result, EMR's three-year annualized dividend growth rate stands at 4.2%.

With a reasonable payout ratio and plenty of free cash flow, investors can count on Emerson Electric to keep the dividend hikes coming.

Dividend growth has been a priority for Dover (DOV), which at 66 consecutive years of annual distribution hikes underscores its commitment to returning cash to shareholders.

The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors. It's not an exciting business, but it can be a remunerative one.

Dover last raised its payout in August 2021, when it upped the quarterly outlay by 1% to 50 cents per share.